Not known Factual Statements About atm skimmer device for sale

Not known Factual Statements About atm skimmer device for sale

Blog Article

Skimmers may be alarming, Nevertheless they’re not the only thing that can go Erroneous at an ATM. It’s a good idea to pay a visit to only ATMs which are in nicely-lit and community regions, also to be familiar with your surroundings while you solution the income equipment. Also, don’t be shy about covering the PIN pad with all your hand to make sure that any shoulder-surfers (or concealed cameras) can’t see your code.

ATM places which can be not in these types of enclosures will be needed to be labled as a result and “consumer beware”.

But worse as I’ve pointed out before the cost of generating these kinds of small grade skimming devices is paltry, even shelling out overblown large Road store price ranges the components as well as the instruments needed to “roll your individual” is a lot less than 1/20th of the prices remaining requested for.

Withdraw money from an ATM with chip possibilities and fork out with tough money When the merchant can’t supply a chip here and PIN selection.

A GSM skimmer eradicates that danger. Thereafter, the skimmer is frequently associated with a Computer program arrange with program that screens the course of action of your device. once you obtain the tracks towards your Computer system procedure, the information is coded for a security evaluate, steering clear of misuse by quite a few Other folks.

The criminals could utilize a camera or possibly a keypad to file his keystrokes, Nevertheless they don’t know which keystrokes would be the PIN. Granted, it is more sophisticated. The financial institution may have to acquire Distinctive accounts for blind people that even now call for just the PIN code. And there may have to be a way for those who discover the Directions perplexing to click on a button that claims, “Just let me enter my four digit PIN.”

nike pas cher March 31, 2011 Why don't you place all ATM’s inside a Faraday enclosure to prevent any wi-fi interaction in any respect. it could block 3G, WiFi and blue tooth transmissions.

contemplate also, how challenging it would be for the standard individual to mentally reverse their PIN selection when a gun is getting pointed at their head/ again. A lot of people in that condition would reverse their PIN incorrectly and find yourself like both of these French PhD college students in London:

POS skimmers is usually concealed throughout the issue-of-sale terminals or handheld devices at retail suppliers or eating areas — perhaps even by pliable staff associates.

JCitizen June 4, 2010 I wouldn’t be so fast to dismiss Magneprint technological know-how; the magnetic particles are crafted working with nanotechnology in a pattern that is exclusive to the person issued the cardboard.

Unpacking the robotic pool skimmer was a breeze, with the packaging meant to generally be user-useful. components were being fast to Identify and retrieve, in addition to the packaging met anticipations In terms of Group and safety to the merchandise.

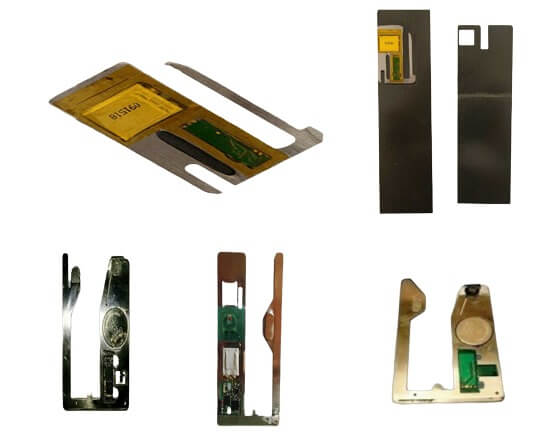

It is made of two most important pieces: The higher portion is really a carefully molded device that matches around the card entry slot and will be able to go through and document the information saved on the cardboard’s magnetic stripe (I apologize for that poor quality of the photographs: According to the Exif details A part of these illustrations or photos, they were being taken previously this year by using a Nokia 3250 cell phone).

usually, these tailor made-produced devices usually are not low-cost, and You furthermore may obtained’t uncover images of them plastered all over the place in the Website. get these photos, as an example, which were attained straight from an ATM skimmer maker in Russia.

as soon as bank card quantities have already been skimmed, hackers can duplicate the information on to blank playing cards, vacation resort keys, or “white actively playing playing cards,” which are effective at self-checkouts, or in problems where by from the thief is mindful the salesperson and is able to “sweetheart” the transaction.

At considered one of my banking institutions, their web page to update 1’s password authorized up to twenty people. What they didn’t let you know is they only made use of the initial 12 people.

Report this page